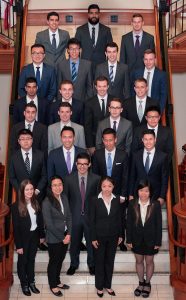

What does a capital markets career in Vancouver entail? I had the pleasure of having this question answered while attending the Beedie Endowment Asset Management (BEAM) Fund Alumni Event. As a current analyst for the BEAM Fund, it was a great experience meeting those who partook in cohorts before mine. The evening consisted of networking with BEAM Alumni from every cohort since BEAM’s inception. Since it’s inception in 2011, six cohorts consisting of between 9 to 15 students have been selected on a competitive basis. These students have gone into Investment Banking, Equity Research, Corporate Finance, Sales & Trading, and many other careers. Of these careers, the most prominent and interesting to me is the wild world of investment banking.

What does a capital markets career in Vancouver entail? I had the pleasure of having this question answered while attending the Beedie Endowment Asset Management (BEAM) Fund Alumni Event. As a current analyst for the BEAM Fund, it was a great experience meeting those who partook in cohorts before mine. The evening consisted of networking with BEAM Alumni from every cohort since BEAM’s inception. Since it’s inception in 2011, six cohorts consisting of between 9 to 15 students have been selected on a competitive basis. These students have gone into Investment Banking, Equity Research, Corporate Finance, Sales & Trading, and many other careers. Of these careers, the most prominent and interesting to me is the wild world of investment banking.

Life as an Investment Banker

The evening began with me rolling into the building (literally rolling because I broke my foot a few weeks before the event and was using a Knee Walker to get around) and seeing some familiar faces. The knee walker was a great ice-breaker as many people had not seen one before and were curious as to how I injured myself.

My first alumni interaction was with Kevin Lowe, an Investment Banker at BMO and a member of BEAM’s second cohort. Having been in the game for over two years now, I wanted to know how the gruelling investment banking hours had changed and whether he was looking to exit into a different career. The turnover in Investment Banking is generally two years, as the long hours are not sustainable. To my surprise, I was informed that Investment Banking hours in Vancouver are not as bad as those in Toronto. Furthermore, he explained that the hours improve as the years go by so he’s not actively looking to exit. The deal flow is also much different than I had imagined. Majority of the deal flow is predominant in Toronto but there are mining and forestry deals here. He explained which banks are more likely to get mining deals (There is a plethora of mining companies in Vancouver) and which will get forestry (BC is Canada’s leading province in the forestry industry).

After chatting some more, Kevin introduced me to Noel Amyot, a member of his cohort and now an Investment Banker at Scotiabank. Once again Noel confirmed what Kevin had stated and I probed further about the deal flow at Scotiabank. As with Kevin, Noel was happy to share his insights and stories of the investment-banking world. Interestingly, there are two BEAM alumni now working for Scotiabank’s investment banking team. The ability of BEAM members to breakthrough in this industry is impeccable.

The second half of the evening involved chatting with a few more Alumni and catching up with senior BEAM members who recently graduated. Having had this opportunity to create relationships with industry professionals was unreal. Even more, just connecting with Alumni and hearing about their experiences in the BEAM Fund and finding their way in the financial industry was very eye opening. I look forward to being on the other end and having the cohorts that succeed mine ask about my experiences.

Learn more about the BEAM Fund and other opportunities in Finance, please check out the BEAM Fund Website and the Finance Recruit Programs.

BIO:

Mandeep Uppal is a fourth-year student pursuing a Bachelor’s in Business Administration with a concentration in Finance and a double major in Actuarial Science. He is also a Teaching Assistant and an Analyst for the Beedie Endowment Asset Management Fund. Mandeep’s favourite pastimes are powerlifting and playing basketball. He believes life is about balance; you need to be on both sides of the spectrum. You can reach him at msuppal@sfu.ca

Mandeep Uppal is a fourth-year student pursuing a Bachelor’s in Business Administration with a concentration in Finance and a double major in Actuarial Science. He is also a Teaching Assistant and an Analyst for the Beedie Endowment Asset Management Fund. Mandeep’s favourite pastimes are powerlifting and playing basketball. He believes life is about balance; you need to be on both sides of the spectrum. You can reach him at msuppal@sfu.ca