News

Jack Austin Centre For Asia Pacific Business Studies

Harper Doctrine a diving catch for Canada’s future: Op-Ed by Jack Austin

Jan 3, 2013

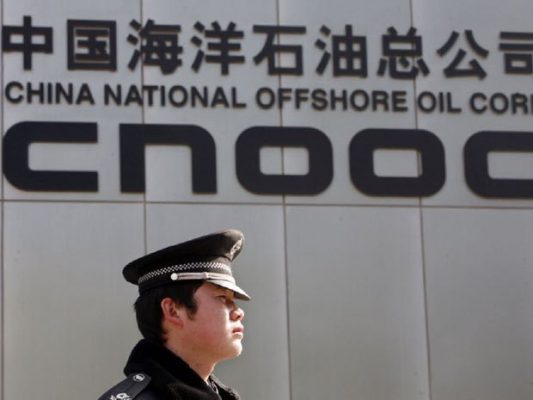

Opinion: Issue of state-owned enterprises erratic, unpredictable. By Jack Austin, Vancouver Sun At a recent symposium hosted at SFU’s Beedie School of Business and the Jack Austin Centre for Asia Pacific Business Studies, I invoked the baseball analogy of a “diving catch” to describe the Harper government’s recent response to offshore bids for Canadian assets, including the somewhat contentious takeover by Chinese government-controlled CNOOC of Calgary’s Nexen. That’s because the issue of state-owned enterprises (SOEs) more »More...

New edition of Ideas@Beedie magazine focuses on international business

Dec 21, 2012

The latest issue of Ideas@Beedie, the new digital magazine from the Beedie School of Business, is now available online, showcasing the school’s academic research, industry impact and engagement with the community. The new edition of Ideas@Beedie focuses on the subject of international business and highlights the breadth and depth of research carried out by the Beedie School of Business faculty on the topic. The research explored in the new issue includes the role of government more »More...

Expert panel dissects role of state-owned enterprises in Canada

Dec 10, 2012

The Beedie School of Business in partnership with the Asia Pacific Foundation of Canada brought together some of the country’s leading experts in Canada-Asia business affairs in hosting a panel discussion on the role of state-owned enterprises (SOEs) in Canada’s economic and political future. The event was held by the Beedie School’s Jack Austin Centre for Asia Pacific Business Studies, and aimed to clarify the most important issues in the role of SOEs in the more »More...

Beedie signs MOU with India Institute of Management Indore

Nov 15, 2011

The Beedie School of Business at SFU has signed a Memorandum of Understanding (MOU) with the India Institute of Management Indore (IIM Indore). The agreement will allow the two institutions to explore additional research programs and exchanges and pursue consulting and project opportunities. Collectively, the India Institutes of Management are the premier business schools in India, and IIM Indore has been ranked #4 in the country. Established in 1996, the institute was chosen to be set up in Indore to give an impetus to management education in central India and has ever since been acting as the pioneer in the field of management, interfacing with the industry and government sectors. Faculty at IIM and SFU currently collaborate in areas such as sustainable supply networks, market segmentation via remanufactured products and profitability of co-operatives in emerging markets. According to Daniel Shapiro, Dean of the Beedie School, the MOU will cover the exchange of students and faculty, and facilitate joint research between IIM Indore and Beedie.More...

Jack Austin Centre analysis: The US/China Currency Dispute, and its Impact on Canada

Oct 24, 2011

Few things rankle Americans more than the sense of dependence on other nations. Dependence creates power in inverse measures. The Chinese government exacerbates this unease by voicing its unhappiness with the central role of the US dollar in the world’s economy. Its vast US dollar holdings – approximately $1.5 trillion – are affected by US monetary policy. As the world’s reserve currency, the US can fund deficits by easing its monetary policies, as the Federal Reserve did in its QEI and QEII efforts to refloat the American economy. A cheaper US dollar means Chinese dollar holdings become less valuable. The Chinese government has indicated that it expects the Yuan to become a reserve currency in the not-too-distant future, and that such a move would be beneficial in that it would reduce the vulnerability of the global economy to the US. China is the second largest economy in the world and there is a sense of inevitability to its increasing economic power. China would like to expand its role in financial markets, building off its economic strengths.More...